are car loan interest payments tax deductible

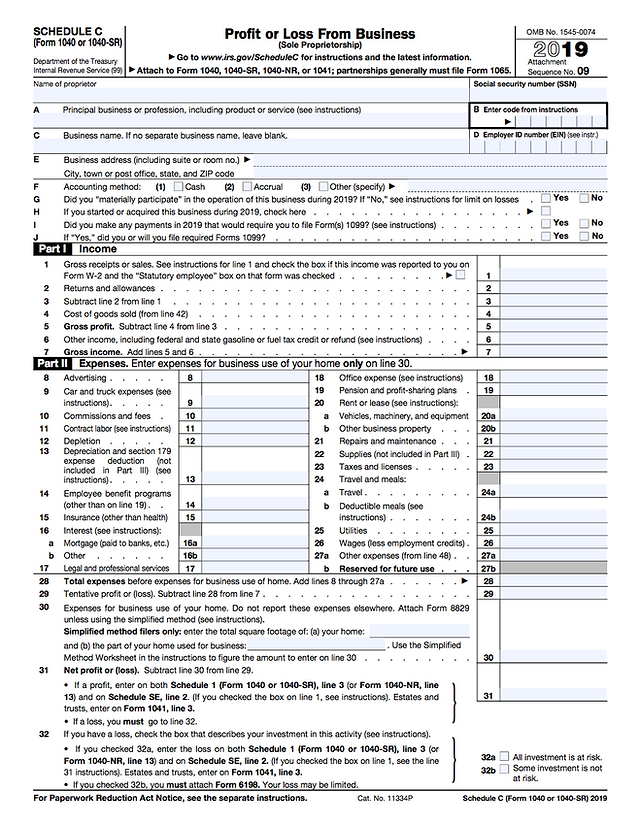

The interest payments made on certain loan repayments can be claimed as a tax deduction on the borrowers federal income. Reporting the interest from these loans as a tax deduction is fairly straightforward.

Can I Write Off My Car Payment For Tax Purposes

Normally the interest paid on personal loans credit cards or car loans are in most cases not tax-deductible.

. Interest on qualified student loans is tax-deductible. The interest you pay on student loans and mortgage loans is tax-deductible. Typically you can only deduct car payments from your tax return if you use the car for business uses.

To deduct interest on passenger vehicle loans take the lesser amount of either. If you use your car for business purposes you may be allowed to partially deduct car loan interest as. But there is one exception to this rule.

Heather determines the motor vehicle expenses she can deduct in her 2021 fiscal. Should you use your car for work and youre an employee you cant write off any of the interest you pay on your. Apr 15 2022 5 min read.

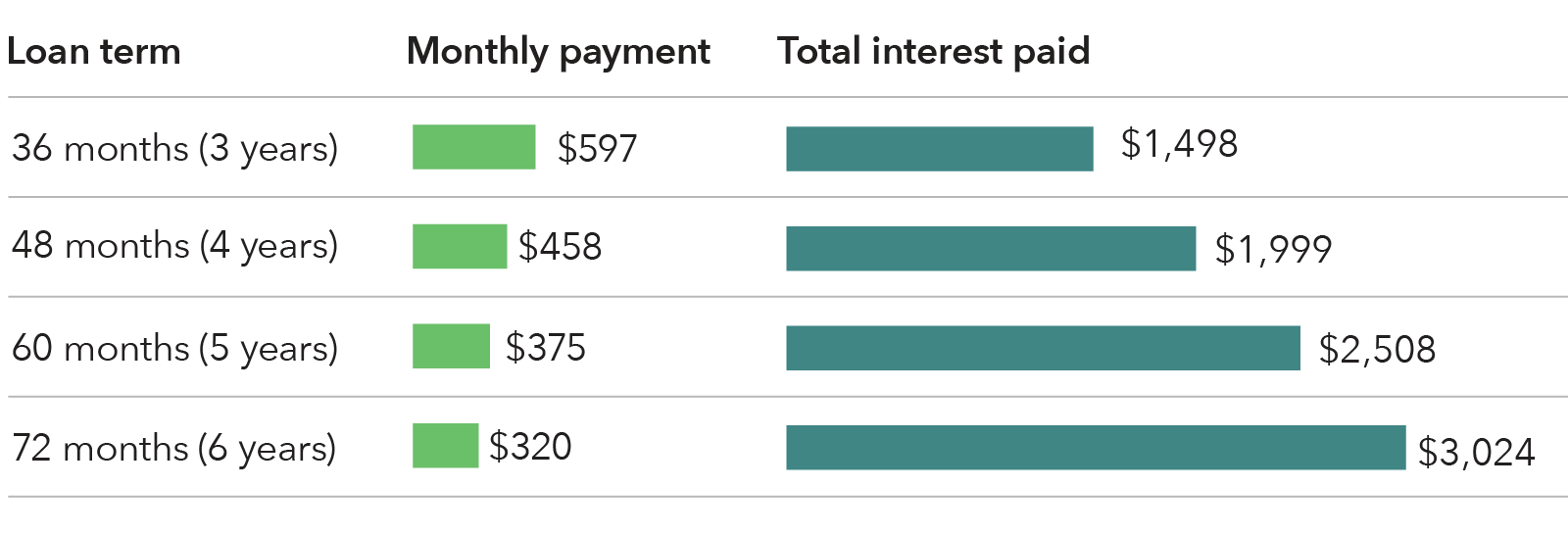

F the car you purchase is for personal use you cant deduct the interest you pay on a car loan from your tax return. 50 of your cars use is for business and 50 is personal. However for commercial car vehicle and.

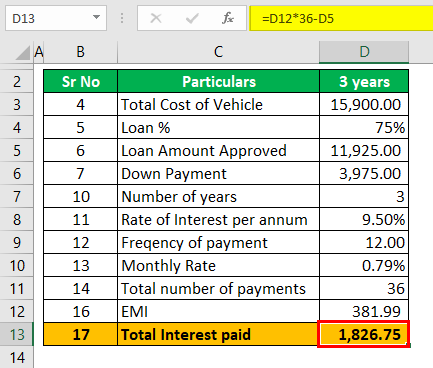

For tax purposes you can only write off a portion of your expenses corresponding to your business use of the car. This is why you need to list your vehicle as a business expense if you wish to deduct the interest. Interest on loan to buy vehicle 2200.

You can only use a loan as tax-deductible if the vehicle is for a business. Of course there is a caveat and its why most people cant use their loan payments as a tax deduction. This means you can deduct some of the cars value from the profits of your business before paying tax.

10 x the number of days for which interest was payable. If you purchase the vehicle and choose to do the actual expense instead of mileage you can write off the actual expenses including gas insurance tires repairs etc as. Business Loans In most cases the interest you pay on your business loan is tax deductible.

Are car loan interest payments tax deductible. Unfortunately car loan interest isnt deductible for all taxpayers. Car loan interest is tax deductible if its a business vehicle.

In most cases interest is a deductible expense on your business tax return and these expenses can include interest on loans mortgages and. You cannot deduct the actual car operating costs if you choose the standard mileage rate. Experts agree that auto loan interest charges arent inherently deductible.

As a result you cant benefit from any deductions for vehicles you use solely. The standard mileage rate already. For vehicles purchased between December 31 1996.

You may claim the cost of a car as a capital allowance. Typically deducting car loan interest is not allowed. For example if your car use is 60 business and 40 personal.

This is true for bank and credit union loans car loans credit card debt lines of. You paid 25000 for the car and you have a 10 percent interest rate which gives you 2500 in loan interest. May 10 2018.

What Are Interest Rates How Does Interest Work Credit Org

Car Payment Calculator U S News World Report

Is A Car Loan Interest Tax Deductible Mileiq

Is A Car Loan Interest Tax Deductible Mileiq

Auto Loan Calculator Car Loan Calculator Not A Toy

How Much Of Your Car Loan Interest Is Tax Deductible Bankrate

Can Interest Paid On Car Loans Be Deducted Jerry

Auto Loan Calculator Calculate Auto Loan Monthly Installment

Car Payment Calculator U S News World Report

Can I Write Off My Car Payment For Tax Purposes

Autosmart Know The Facts 0 Financing

:max_bytes(150000):strip_icc()/pros-cons-personal-loans-vs-credit-cards-v1-4ae1318762804355a83094fcd43edb6a.png)

Personal Loans Vs Credit Cards What S The Difference

Is Car Loan Interest Tax Deductible And How To Write Off Car Payments

Is Buying A Car Tax Deductible In 2022

Don T Get Taken For A Ride Protect Yourself From An Auto Loan You Can T Afford Consumer Financial Protection Bureau

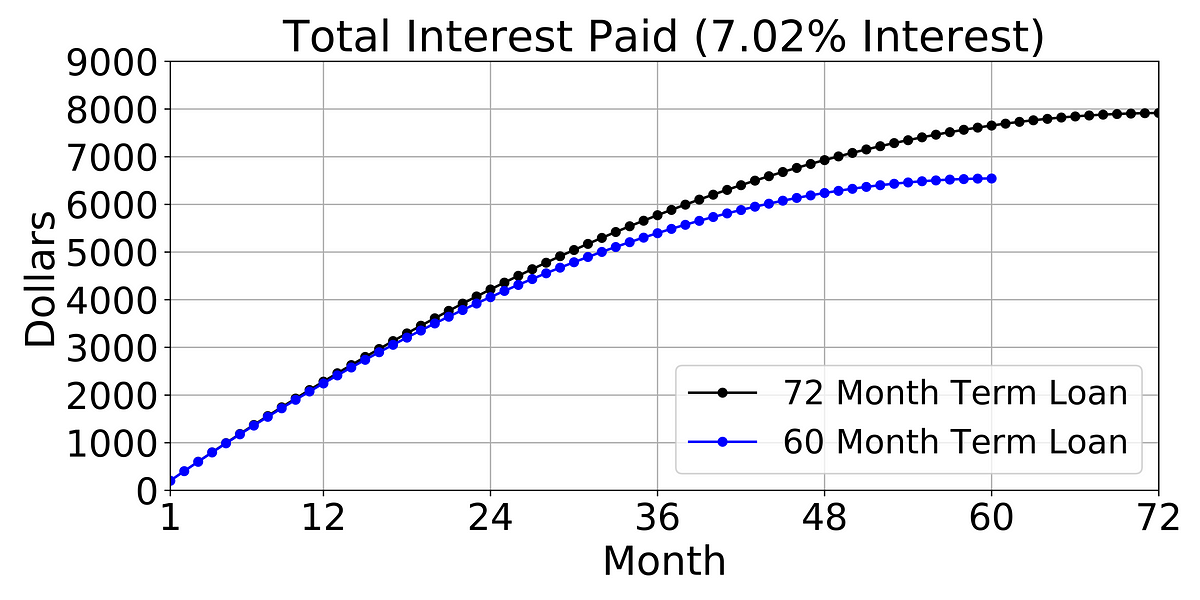

The Cost Of Financing A Car Car Loans By Michael Galarnyk Towards Data Science

Home Equity Loans Can Be Tax Deductible Nextadvisor With Time